Acerbi & Szekely Unconditional Expected Shortfall Test

June 19, 2020

Python implementation of the Direct Expected Shortfall Test of Acerbi and Szekely (2014).I don’t know of any implementation of such test in Python. The test has been implemented in MatLab. The backtesting of Expected Shortfall has long been a difficult task due to the lack of elicitibility. The test I’ve implemented is the second test of Acerbi and Szekely and it’s full details are in the reference.

Input

##

## X_obs (np.array): Numpy array of size 1xT containing the actual

## realization of the portfolio return.

##

## X (function): Function that simulates (outputs) a realization of the

## portfolio return under H0:

## X^s = (X_1^s, X_2^s,..., X_T^s), with X_t^s ~ P_t for all

## t = 1 to T.

## Output should be a numpy array of 1xT.

##

## VaRLevel (float): Number describing the level of the VaR, say 0.05 for

## 95% or 0.01 for 99%.

##

## VaR (np.array): Numpy array of size 1xT containing the projected

## Value-at-Risk estimates for t = 1 to T at VarLevel.

## VaR must not be reported in its positive values, but

## rather in its actual values, usually negative.

##

## ES (np.array): Numpy array of size 1xT containing the projected

## Expected Shortfall estimates for t = 1 to T at VaRLevel.

## ES must not be reported in its positive values, but

## rather in its actual values, usually negative.

##

## nSim (int): Number of Monte Carlo simulations, scenarios, to obtain the

## distribution of the statistic under the null hypothesis of

## P_t^[VaRLevel] = F_t^[VaRLevel].

##

## alpha (float): Number in [0, 1] denoting the Type I error, the

## significance level threshold used to compute the

## critical value. Default set at 5%

##

## print_results (boolean): Boolean for whether results should be printed.

## Examples

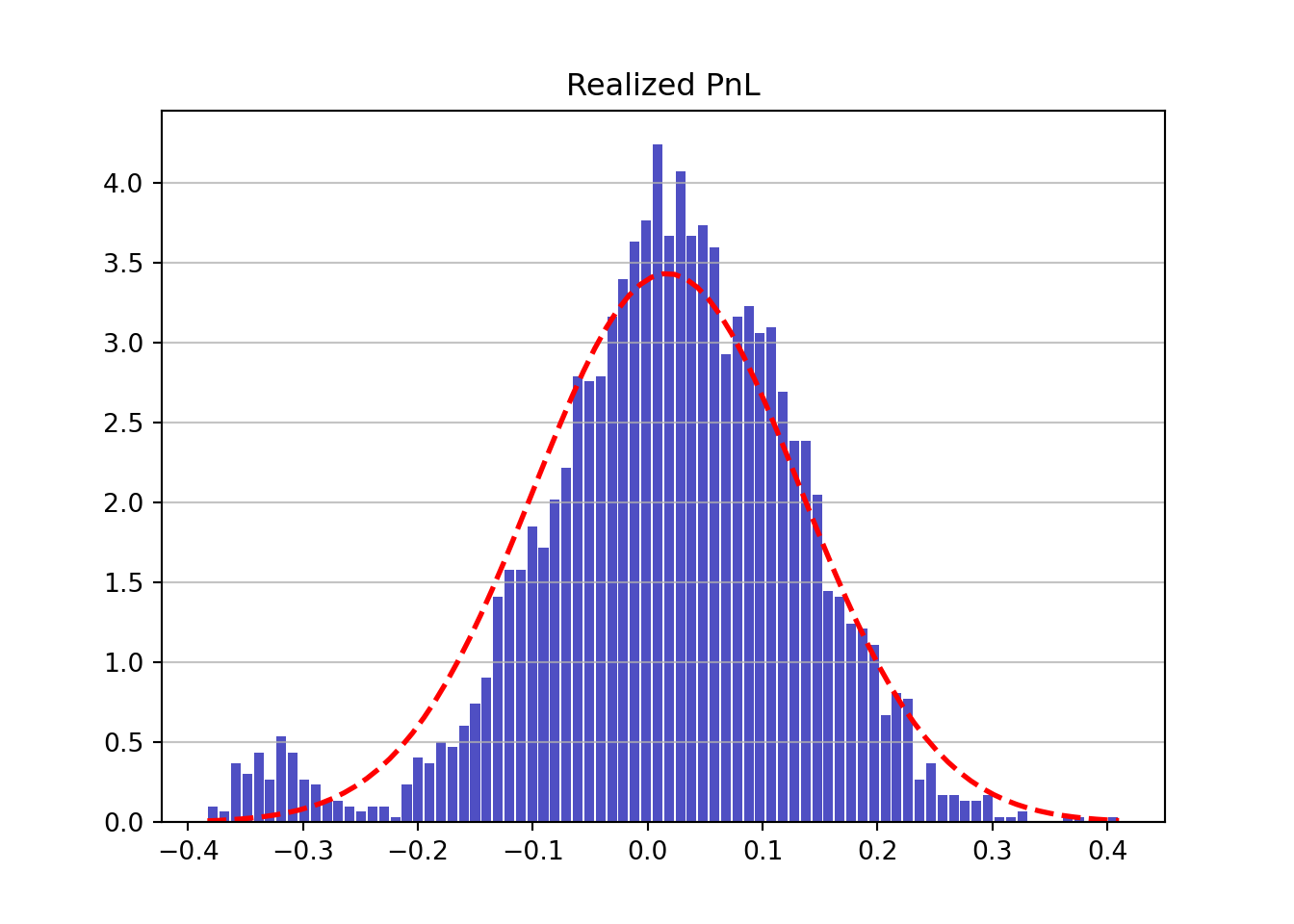

We run the test under two different scenarios. In the first scenario the portfolio returns are generated from a normal distribution mixture such that there is a bump in the left tail compared to a normal distribution. In the second case the portfolio returns are generated form a normal.

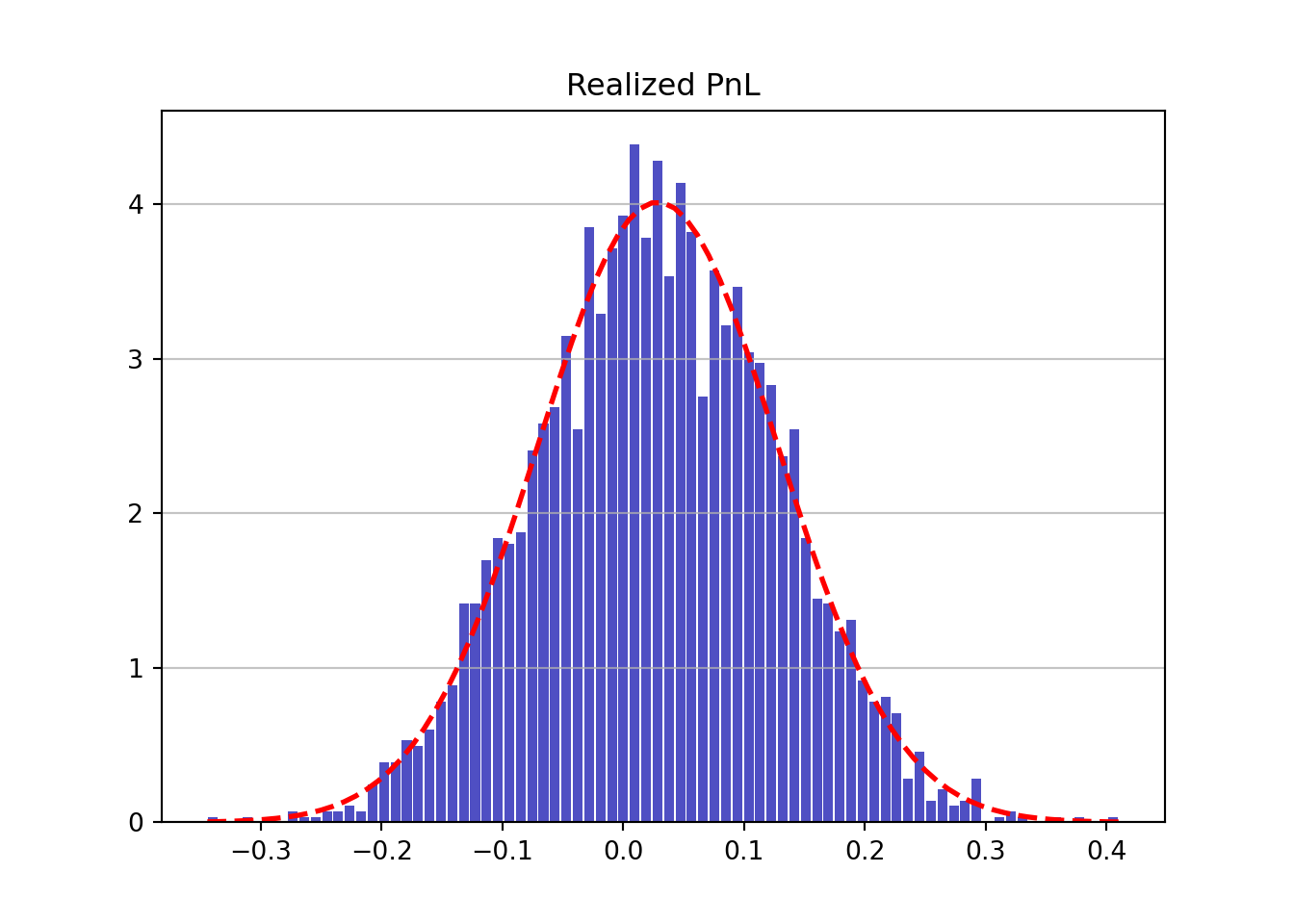

Then returns are always assumed to follow a normal distribution with the sample mean and variance. We can observe that the Value at Risk and Expected Shortfall estimates at 95% are strongly rejected in the first case but not in the second case.

The first case is:

\[ TDGP: r_t \sim \ \ \text{i.i.d} \ \ \mathbb{1}_{\phi_t = 0} \mathcal{N}(\mu_{standard}, \sigma_{stress}) + \mathbb{1}_{\phi_t = 1} \mathcal{N}(\mu_{stress}, \sigma_{stress}) \] where \(\phi_t \sim\) i.i.d \(Bernoulli(p)\).

\[ Model: r_t \sim \ \ \text{i.i.d} \ \ \mathcal{N}(\hat{\mu}, \hat{\sigma}) \]

## ----------------------------------------------------------------

## Direct/Unconditional Expected Shortfall Test by Simulation

## ----------------------------------------------------------------

## Number of observations: 3000

## Number of VaR breaches: 156

## Expected number of VaR breaches: 150.0

## ES Statistic: -0.29866795648622135

## Expected ES Statistic: 0

## Critical Value at α = 0.05: -0.13574459537691758

## p-value: 0.0002

## Number of Monte Carlo simulations: 10000

## ----------------------------------------------------------------The second case is:

\[ TDGP: r_t \sim \ \ \text{i.i.d} \ \ \mathcal{N}(\mu_{standard}, \sigma_{standard}) \]

\[ Model: r_t \sim \ \ \text{i.i.d} \ \ \mathcal{N}(\hat{\mu}, \hat{\sigma}) \]

## ----------------------------------------------------------------

## Direct/Unconditional Expected Shortfall Test by Simulation

## ----------------------------------------------------------------

## Number of observations: 3000

## Number of VaR breaches: 144

## Expected number of VaR breaches: 150.0

## ES Statistic: 0.05483829919134353

## Expected ES Statistic: 0

## Critical Value at α = 0.05: -0.13545881827342304

## p-value: 0.7471

## Number of Monte Carlo simulations: 10000

## ----------------------------------------------------------------References

Acerbi, Carlo, and Balazs Szekely. “Back-testing expected shortfall.” Risk 27.11 (2014): 76-81.